Seasonal Tendencies: The Commodity Trader’s Ace in the Hole

If there has ever been a more controversial, misunderstood, overregulated, in and out of vogue tool for “forecasting” specific commodities prices, it is seasonal tendencies.

To define, Seasonal tendencies, or “seasonals” as they are known, are the tendencies of the price of a commodity to move in a particular direction during a specific time of year.

Many people have misunderstood or misapplied the concept of commodity seasonals, leading to widespread skepticism about their utility. Initially, the allure of “can’t lose” trades based on seasonal patterns attracted attention and optimism. This enthusiasm was bolstered by high-profile successes and the proliferation of advice and strategies centered around these patterns. However, the realization that losses were indeed possible when trading commodities led to a rapid decline in interest and trust in seasonal trading strategies.

Seasonal price tendencies are rooted in recurring commodity events that happen around the same time each year, offering valuable insights into potential market movements. Unfortunately, the details of effectively employing these tendencies were often overlooked. The critical error many made was not in acknowledging the existence of seasonal trends but in how they interpreted and acted on these patterns. Specifically, the mistake lay in treating seasonal trends as a basis for a rigid trading timeline rather than as indicators of broader market trends. This misunderstanding underscores the need for a multifaceted approach to incorporating seasonal trends into trading strategies, emphasizing the importance of general market direction over precise timing.

Used correctly, seasonal tendencies can be a powerful tool for commodities investors. We felt them so important that we devoted two entire chapters to seasonals in The Complete Guide to Option Selling.

The good news is that seasonal tendencies are still alive and well in the commodities markets and available to anyone who wishes to interpret their compelling data. No, they are not perfect. However, they cannot be discounted as a significant fundamental factor in almost any commodity market. In fact, I often use it as a starting point when analyzing new option trades.

Seasonal tendencies do have their drawbacks. First and foremost, past performance is not indicative of future results. Just because it happened last year, or even the previous ten years, doesn’t mean it will happen this year.

________________________________________________________________________

….seasonal tendencies are still alive and well in the commodities markets….

________________________________________________________________________

Season tendencies are just that, tendencies. This means prices have, in the past, tended to move in a certain direction during a certain time of year. However, there are no guarantees as to what point in that period prices will move, how far they will move, or if they will even move. No promises are made that prices will not spasm sharply in the opposite direction than they are “supposed” to move, right before aligning with a seasonal tendency.

It is true that commodities “seasonals” have their limitations. However, it is my guess that the difficulties of seasonal analysis are more of a problem for futures traders than option sellers. Futures traders have the burden of having to pick market direction and have nearly perfect timing. This makes trading futures contracts in line with seasonals more difficult.

This fact alone makes seasonal tendencies and option selling a potent combination. However, one cannot mindlessly assume that prices will automatically move in a manner consistent with a seasonal chart. Seasonal tendencies are driven by underlying fundamentals that tend to happen simultaneously each year.

For instance, soybean prices tend to gain strength after the US autumn harvest as demand begins to whittle away at storage supplies. This trend can often continue into Spring as anxiety over planting influences trader attitudes.

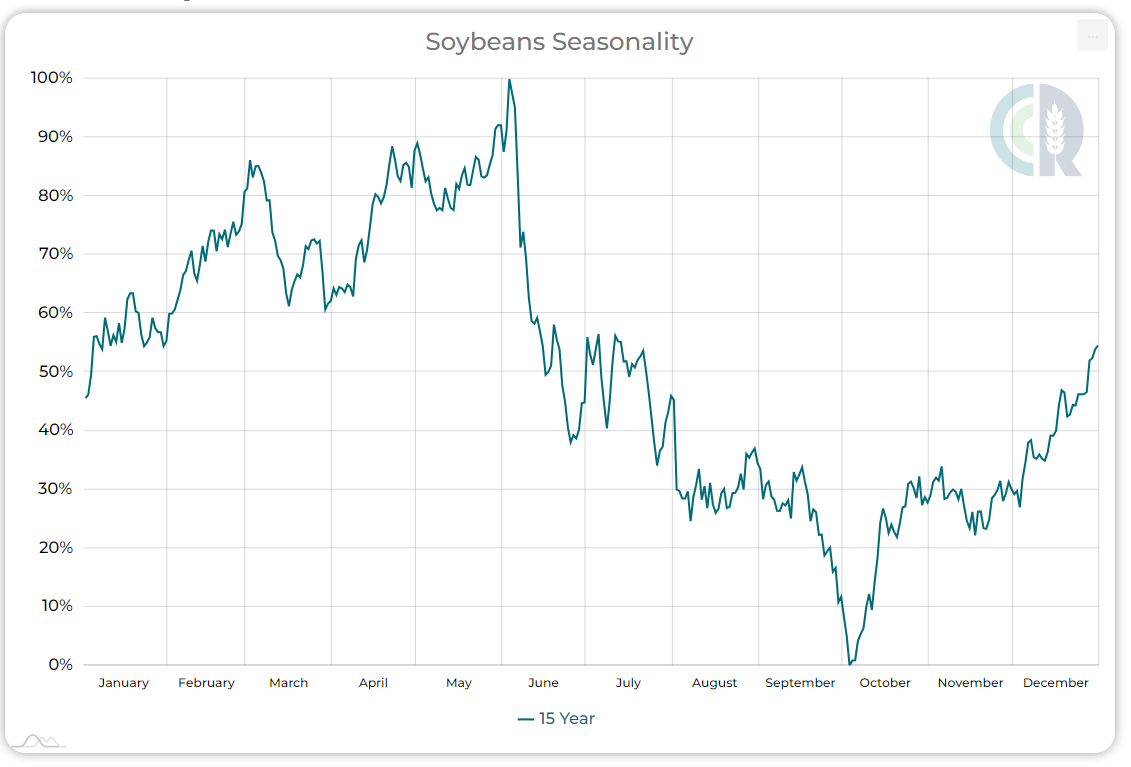

The mistake that novice traders make with seasonals is the assumption that these tendencies provide you with an exact roadmap of what prices should do. The novice may assume from the chart below that if you buy soybeans on October 1, and sell it on February 28th, you will be assured a profit. It’s just more complex. What if harvest finishes early or the crop comes in smaller than expected? Prices could react sooner, and you would miss the move. What if the crop comes in larger than expected, or something happens to crimp demand? You could buy right before the market begins an “unexpected” move lower, or simply doesn’t move at all.

A 15-year seasonal chart of March soybeans shows that, on average, soybean prices have tended to rise beginning in October. You must consider, however, that this chart represents a mere average and that individual years can vary depending on overall fundamentals. Nonetheless, seasonal charts can be an invaluable tool to fundamentally based option sellers.

Note to Chart Readers: The numbers on the left of the chart do not represent absolute prices but rather, a percentage of lowest and highest price for the year. It is the overall pattern on which option selling investors should place their focus.

* The above is an Average of price movements only. Individual years may vary. Past performance is not indicative of future results.

______________________________________________________________________

This is why Option Selling is preferable to trying to trade the actual contracts on a seasonal move. The option seller can still see his option expire worthless if he is early, late, or even if the move does not occur at all. Only in an extreme counter-seasonal move does the option seller lose. Not so for the futures trader.

Seasonal factors can put more weight on one side of the bull/bear see saw

You must also be careful not to discount the relative nature of seasonal tendencies. Think of the opposing factors moving different commodities prices as two weights on either side of a seesaw. Rarely is all the weight on one side. Seasonal factors can put more weight on one side of the seesaw. However, that does not mean an even heavier counterweight cannot come down on the other side – negating the seasonal effect. A wise option seller should always give seasonals their due. But they should be taken within the overall fundamental and technical picture context.

Conclusion

While you cannot always base a trade on them, I believe seasonal tendencies can be an invaluable tool for option sellers.

Just don’t always take them at pure face value. Knowing the fundamentals that drive these tendencies will give your seasonal analysis a more valuable perspective. However, combining seasonal tendencies with the strategy of selling options can pack a powerful punch. Knowing them can give you an advantage over technical traders unfamiliar with seasonals – an “ace in the hole” if you will.

Past performance is not necessarily indicative of future results. Futures and options trading involves risk of loss. Only risk capital should be used.